The world of cryptocurrency offers a multitude of investment opportunities, and futures trading presents a unique avenue for experienced traders seeking potentially amplified returns. However, venturing into this fast-paced realm requires a deep understanding of the risks and rewards involved. This comprehensive guide equips you with the knowledge and tools to navigate the exciting, yet challenging, landscape of cryptocurrency futures trading.

Table of Contents

- 1 What is Futures Trading:

- 2 Difference between Spot trading and Futures Trading:

- 3 Benefits and Risks of Future Trading:

- 4 Lets Learn How to do Future Trading:

- 5 Understanding Future Contracts:

- 6 Contract Types:

- 7 What is Leverage and Margin in Future Trading?

- 8 Isolated Margin vs. Cross Margin:

- 9 Technical Analysis in Future Trading:

- 10 Risk Management in Future Trading:

- 11 Step-by-Step Guide to Futures Trading on Cryptocurrency Exchanges:

- 12 Get Set Up:

- 13 Trading Basics:

- 14 Placing Your First Trade:

- 15 Risk Management:

- 16 Backtesting and Refinement:

- 17 Staying Informed:

- 18 Practical Tips and Best Practices to Get Success in Future Trading:

- 19 Conclusion:

What is Futures Trading:

At its core, futures trading involves contracts that obligate parties to buy or sell an asset at a predetermined price on a specific future date. In the context of cryptocurrency, these contracts represent agreements to buy or sell a specific digital currency at a particular price by a set future date.

Difference between Spot trading and Futures Trading:

- Spot Trading: When you buy cryptocurrency through spot trading, you acquire immediate ownership of the digital asset. The price you pay is based on the current market value.

- Futures Trading: With futures contracts, you don’t take immediate ownership of the cryptocurrency. Instead, you’re speculating on the price movement at the expiry date of the contract.

Benefits and Risks of Future Trading:

The allure of futures trading lies in its potential for magnified profits. By employing leverage, traders can control a larger contract size with a smaller initial investment. Imagine you believe Bitcoin’s price will rise. With a 10x leverage, a $1000 investment could control a $10,000 contract. If Bitcoin’s price increases by 10%, your profits would also be amplified by 10x, resulting in a $1000 gain on your initial $1000 investment (excluding fees).

However, this leverage cuts both ways. If the market moves against your prediction, your losses are also magnified. In the same scenario, a 10% price decrease in Bitcoin would result in a $1000 loss, wiping out your entire initial investment and potentially forcing liquidation (explained later).

Lets Learn How to do Future Trading:

Before diving in, it’s crucial to choose a reputable cryptocurrency exchange that offers futures trading. Research the exchange’s security measures, trading fees, and available leverage options. Once you’ve selected a platform, create an account and complete the necessary verification procedures to ensure secure trading. Familiarize yourself with the exchange’s interface and trading tools, including order types, charts, and margin management features.

Understanding Future Contracts:

Futures contracts are the building blocks of futures trading. Each contract specifies:

- Underlying Asset: The cryptocurrency you’re speculating on (e.g., Bitcoin, Ethereum).

- Contract Size: The predetermined amount of the cryptocurrency represented by the contract (e.g., 1 BTC, 10 ETH).

- Expiry Date: The specific date on which the contract obligations must be fulfilled.

Contract Types:

- Perpetual Contracts: These contracts don’t have a fixed expiry date and are automatically rolled over into a new contract with a renewed funding fee at regular intervals.

- Quarterly Contracts: These contracts expire every three months, requiring settlement or rollover into a new contract before expiry.

What is Leverage and Margin in Future Trading?

Leverage allows you to control a larger contract size with a smaller initial investment, called the margin. The margin requirement varies depending on the exchange and the chosen leverage ratio. For example, a 10x leverage means you only need to put up 10% of the contract value as margin. However, remember, higher leverage amplifies both profits and losses.

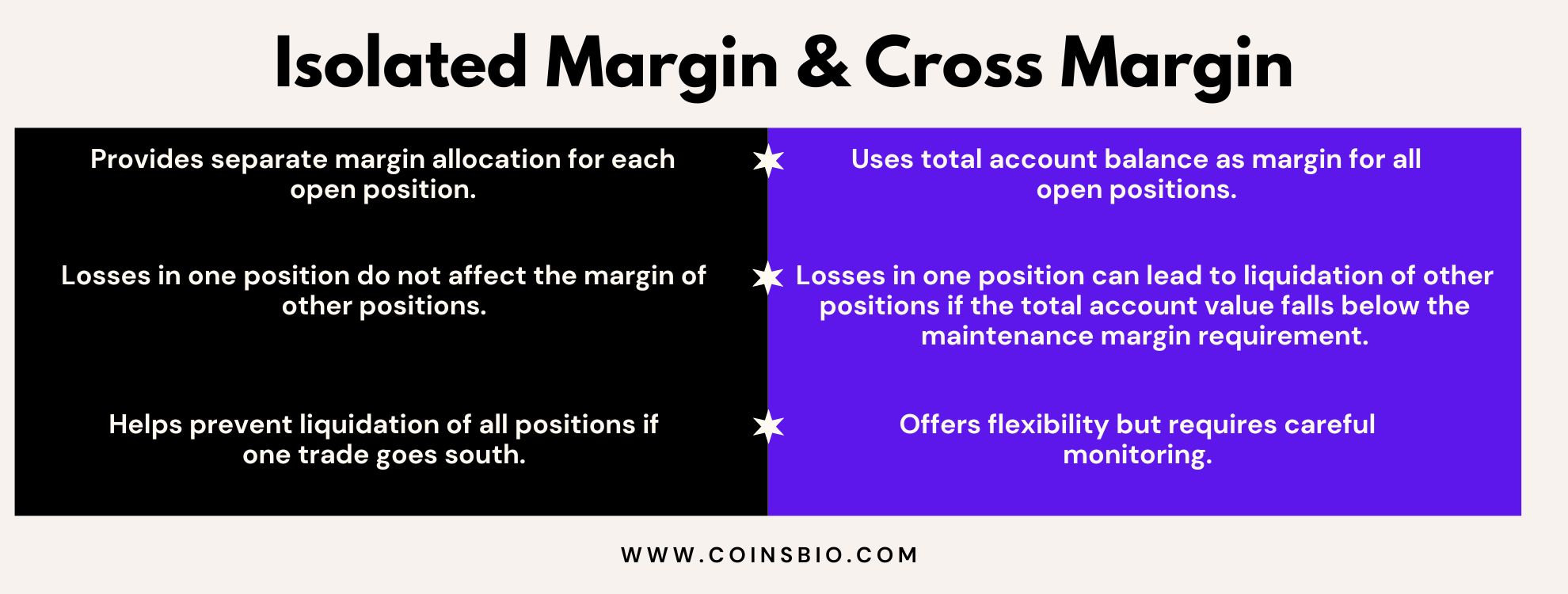

Isolated Margin vs. Cross Margin:

- Isolated Margin: This system allocates margin specifically for each open position. A loss in one position doesn’t affect the margin of other positions.

- Cross Margin: This system uses your total account balance as margin for all open positions. A loss in one position can lead to liquidation of other positions if the total account value falls below the maintenance margin requirement.

Technical Analysis in Future Trading:

Technical analysis focuses on historical price and volume data to identify potential future price movements. While not foolproof, technical indicators can be valuable tools for informed decision-making. Here are some common indicators used in futures trading:

- Moving Averages: These smooth out price fluctuations to identify trends and potential support and resistance levels.

- Relative Strength Index (RSI): This measures the momentum of price movements and suggests potential overbought or oversold conditions.

- Bollinger Bands: These bands depict price volatility and can signal potential breakout or breakdown points.

Candlestick Charts: These charts visually represent price movements over a specific time frame, providing valuable insights into market psychology. Understanding candlestick patterns like bullish engulfing or bearish engulfing can aid in identifying potential reversal points.

Risk Management in Future Trading:

The fast-paced world of futures trading demands a robust risk management strategy. Here are some key practices to safeguard your capital:

- Stop-Loss and Take-Profit Orders: These automated orders help mitigate potential losses and lock in profits. A stop-loss order automatically sells your contract if the price reaches a predetermined level, limiting your losses. A take-profit order automatically sells your contract when the price reaches your desired profit target.

- Calculating and Managing Leverage: While leverage can amplify profits, it also magnifies losses. Always choose a leverage ratio that aligns with your risk tolerance and trading experience. Start with lower leverage and gradually increase it as you gain experience. Monitor your account value closely and be prepared to reduce your position size or add maintenance margin to avoid liquidation.

- Developing a Trading Strategy: Don’t enter trades impulsively. Create a well-defined trading strategy that outlines your entry and exit points, risk tolerance, and position sizing. This strategy should incorporate technical analysis, fundamental analysis (evaluating factors affecting the overall cryptocurrency market), and your individual risk appetite.

Step-by-Step Guide to Futures Trading on Cryptocurrency Exchanges:

Get Set Up:

- Create an account crypto exchanges like Binance and Bitget and complete verification.

- Fund your account with your preferred method.

- Familiarize yourself with the exchange’s futures interface.

Trading Basics:

- Pick a futures contract (perpetual or quarterly) for your desired crypto.

- Understand leverage and margin: higher leverage = higher risk/reward.

- Practice with a demo account (highly recommended!)

Placing Your First Trade:

- Select your contract and order type (market or limit).

- Choose your leverage ratio (start low!).

- Enter your desired contract quantity.

- Review, confirm, and monitor your position.

Risk Management:

- Use stop-loss and take-profit orders.

- Watch the maintenance margin to avoid liquidation.

- Start small, scale gradually, and prioritize risk management.

Remember: Crypto futures are high-risk. Only invest what you can afford to lose, develop a trading strategy, stay disciplined, and always keep learning!

Backtesting and Refinement:

Before deploying your strategy with real capital, conduct backtesting using historical data. This allows you to evaluate the strategy’s effectiveness and identify potential weaknesses. Use the insights from backtesting to refine your strategy and enhance its performance.

Staying Informed:

The cryptocurrency market is dynamic and constantly evolving. Staying informed about industry news, regulatory changes, and technological advancements is crucial for making informed trading decisions. Utilize a variety of resources, including:

- Cryptocurrency News Sites: Stay updated on the latest developments within the cryptocurrency space.

- Market Analysis Platforms: Follow the insights of reputable analysts to gain broader market perspectives.

- Social Media and Forums: Engage with the cryptocurrency community to learn from experienced traders and gather diverse viewpoints. However, be cautious of unsubstantiated information and exercise independent judgment.

Practical Tips and Best Practices to Get Success in Future Trading:

- Start Small, Scale Gradually: Begin with smaller investments to gain experience and manage risk effectively. As your knowledge and confidence grow, you can gradually increase your position sizes.

- Emotions vs. Logic: The fast-paced nature of futures trading can trigger emotional responses. Develop emotional discipline and stick to your predefined trading plan to avoid impulsive decisions based on fear or greed.

- Learn from Every Trade: Every trade, successful or unsuccessful, offers valuable lessons. Analyze your wins and losses to identify areas for improvement and continuously refine your trading approach.

Conclusion:

Cryptocurrency futures trading offers a path towards potentially amplified returns, but it’s a high-risk, high-reward endeavor. By thoroughly understanding the concepts, meticulously managing risk, and continuously honing your skills, you can navigate this dynamic market with a well-informed approach. Remember, success in futures trading requires discipline, patience, and a commitment to lifelong learning. This guide equips you with the foundational knowledge to embark on your futures trading journey. However, it’s crucial to conduct your own research, practice with simulated trading, and prioritize risk management before venturing into the real market.

Add a Comment