Table of Contents

- 1 What is Aevo (AEVO)?

- 2 How Does Aevo (AEVO) Works?

- 3 What are the Features of Aevo (AEVO)?

- 4 Aevo (AEVO) Tokenomics:

- 5 Aevo (AEVO) Team:

- 6 Monthly Returns:

- 7 How to Buy AEVO Token?

- 8 Factors that Could Potentially Contribute to a Rise in the Price of Aevo (AEVO) Token:

- 9 Important to Consider:

- 10 Frequently Asked Questions:

- 11 What is Aevo?

- 12 What are the advantages of Aevo?

- 13 Is Aevo safe?

- 14 What types of derivatives can I trade on Aevo?

- 15 What is the AEVO token used for?

- 16 Is Aevo a good investment?

- 17 Who are the founders of Aevo?

What is Aevo (AEVO)?

Aevo (AEVO) is shaking things up in the world of crypto derivatives trading. Built on a special layer 2 technology called OP Stack, Aevo boasts lightning-fast speeds, processing over 5,000 transactions per second. This eliminates the lag often experienced on traditional exchanges. Despite being decentralized (meaning no single entity controls it), Aevo offers a familiar order book system, making it user-friendly even for beginners.

Security remains a top priority, as Aevo leverages the robust security of the Ethereum blockchain. With a potential trading volume exceeding $10 billion, Aevo has the potential to become a major player in the crypto derivatives space. Excitingly, Aevo recently partnered with Ribbon Finance and is exploring a rebranding and token swap, potentially converting the RBN token to AEVO. While the complete details of their tokenomics are still under wraps, Aevo promises to unveil them soon. Overall, Aevo presents a compelling option for those seeking a fast, secure, and familiar platform for options and perpetual trading.

Launched In: Mar 2024

How Does Aevo (AEVO) Works?

Aevo combines the best of both worlds for secure and efficient derivatives trading. Here’s the breakdown:

- Off-Chain Speed: Orders are matched quickly outside the blockchain, avoiding congestion and delays.

- Risk Management: A built-in risk engine ensures traders maintain enough collateral to prevent risky situations.

- On-Chain Security: Once matched, trades are settled securely on the Ethereum blockchain for ultimate transparency.

- Faster Transactions: Aevo utilizes a custom layer 2 technology for high-speed transactions while inheriting Ethereum’s security.

- Automated Liquidations: If a trader’s position falls below the minimum margin requirement, the system automatically reduces it to minimize risk and protect the platform’s health.

This innovative blend of on-chain and off-chain features allows Aevo to offer a secure and speedy experience for options and crypto futures trading.

What are the Features of Aevo (AEVO)?

Aevo offers a variety of tools to elevate your derivatives trading experience:

- Aevo Perp (Futures Contracts): Similar to Binance Futures, Aevo Perp lets you trade crypto assets with leverage (up to 20x) on a wider range of coins, including altcoins and even a unique “FRIEND-USD” contract. It also provides real-time market updates and listings.

- Aevo Option: Don’t just buy or sell – make informed decisions with options contracts. Aevo Option allows you to buy options with various expiry dates (daily to yearly) on an order book filled by market makers. Options can be a powerful tool for managing risk, but make sure you understand them before diving in.

- Aevo OTC (Over-The-Counter): Trade options contracts directly with other users on a peer-to-peer (P2P) basis. Aevo OTC offers increased transparency and simplicity compared to traditional methods. You choose the altcoin, expiry time, and conduct the transaction directly on the platform.

- Advanced Features:

- Theta Vault: Become a market maker by selling options contracts and earn fees, but be aware of potential risks.

- Earn Vaults: Deposit funds and earn interest by providing liquidity to the market.

- Portfolio Tracker: Monitor your positions, track trading history, and optimize your strategy with ease.

- Referral Program: Invite friends and earn rewards.

With Aevo, you have the tools and flexibility to trade derivatives with confidence.

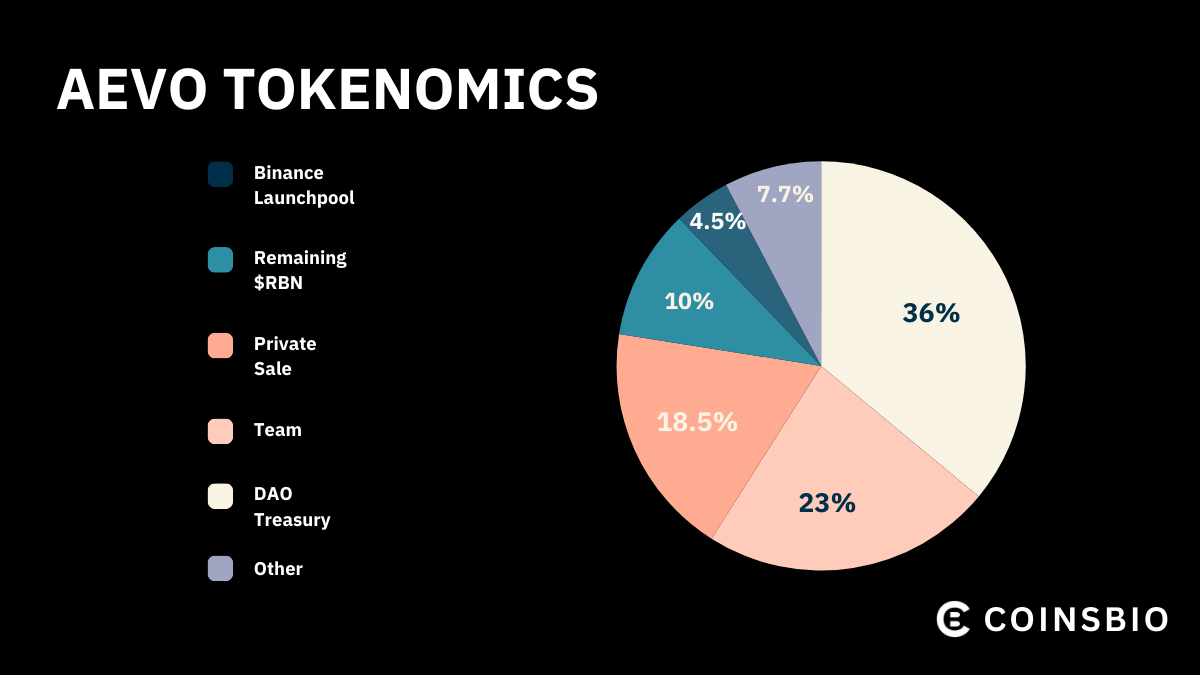

Aevo (AEVO) Tokenomics:

Token address (Ethereum): 0xB528edBef013aff855ac3c50b381f253aF13b997

Total Supply:1,000,000,000

Aevo (AEVO) Team:

Aevo is founded by co-founders Julian Koh and Ken Chan.

Monthly Returns:

Lets Check the price history of AEVO token since Launch:

| Month | Returns |

|---|---|

| Apr 2024 | -53.01% |

| Mar 2024 | -88.08% |

How to Buy AEVO Token?

If you have decided to invest in the AEVO token, here are the steps to buy tokens:

- Create a cryptocurrency exchange account: AEVO is listed on several exchanges, including Binance, Bybit, MEXC, Bitget and Gate.io. Therefore, the first step is to create an account on one of these exchanges.

- Deposit funds: Once your account is set up, deposit funds into your exchange wallet.

- Purchase AEVO : Using the deposited funds, you can buy AEVO tokens directly on the exchange.

Factors that Could Potentially Contribute to a Rise in the Price of Aevo (AEVO) Token:

- DeFi Boom: If DeFi keeps growing, demand for user-friendly derivatives platforms like Aevo (with its fast speeds and altcoin support) could rise, boosting AEVO token value.

- Platform Strength: An easy-to-use platform with strong features and partnerships could attract more users, increasing demand for AEVO tokens.

- Tokenomics: Token burning (reducing total supply) and expanding token utility within the platform (e.g., governance, discounts) could make AEVO more valuable.

- Market Factors: A bullish overall crypto market and positive press/community sentiment could also influence the price.

Important to Consider:

It’s crucial to remember that the cryptocurrency market is inherently volatile, and these are just potential factors. The actual price of AEVO token can fluctuate significantly based on various market forces and unforeseen events.

Frequently Asked Questions:

What is Aevo?

Aevo is a decentralized platform built on layer 2 technology, offering fast and secure derivatives trading for options and perpetual contracts.

What are the advantages of Aevo?

Aevo combines speed and security by utilizing off-chain order books for rapid matching and on-chain settlement via Ethereum smart contracts. It also supports a wide range of assets, including altcoins, and offers innovative features like Theta Vaults and Earn Vaults.

Is Aevo safe?

Aevo leverages the security of the Ethereum blockchain for settlements, while off-chain order books improve transaction speeds. However, as with any DeFi platform, it’s crucial to do your own research and understand the inherent risks involved in cryptocurrency investments.

What types of derivatives can I trade on Aevo?

Aevo offers perpetual contracts (Aevo Perp) with leverage for various crypto assets, including altcoins. You can also trade options contracts (Aevo Option) with expiry dates ranging from daily to yearly.

What is the AEVO token used for?

AEVO tokens are the native currency of the Aevo platform. They are used for various purposes, including paying fees, participating in governance (if implemented), and potentially receiving platform benefits in the future.

Is Aevo a good investment?

The decision to invest in AEVO depends on your risk tolerance and investment goals. Carefully consider the potential benefits and risks involved before making any investment decisions.

Who are the founders of Aevo?

Aevo is founded by co-founders Julian Koh and Ken Chan.