The cryptocurrency market is a land of opportunity, but also a graveyard of failed projects. A recent study by CoinGecko reveals a dark reality of crypto: over 50% of all cryptocurrencies launched since 2014 are now considered dead. That’s right, more than 14,000 digital currencies have gone bust.

Table of Contents

Dead Coins Report:

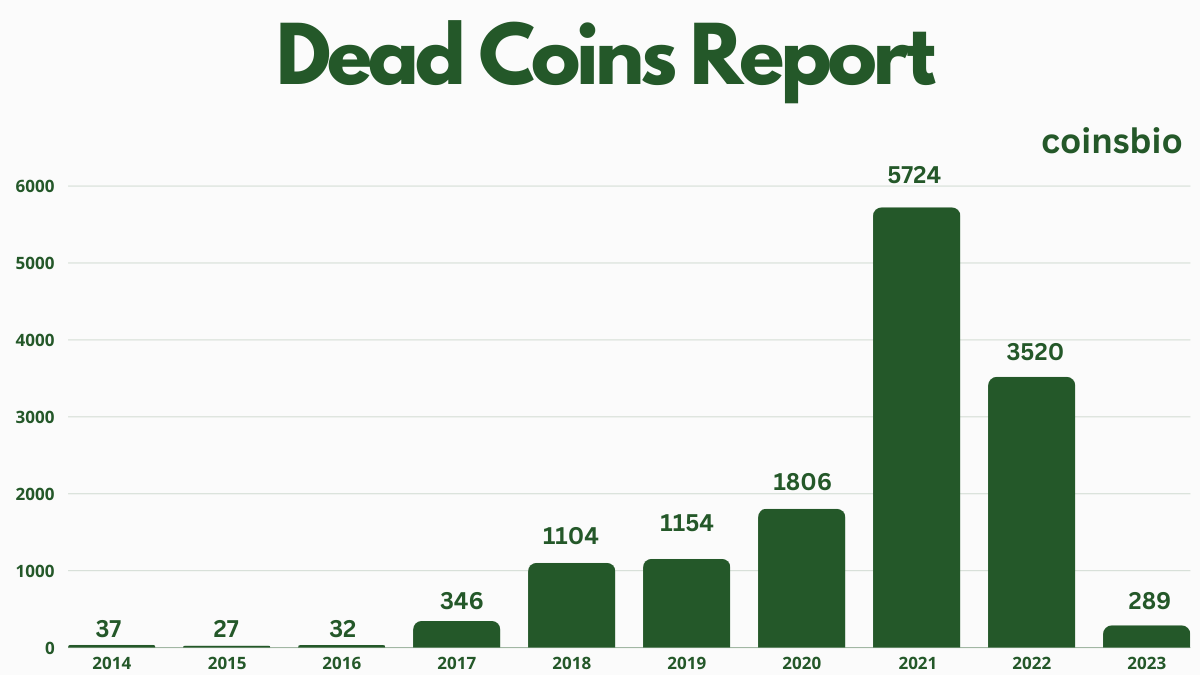

The findings highlight the boom-and-bust nature of the crypto market. The period between 2020 and 2021, a time of explosive growth, also witnessed the highest number of project failures. Over 7,500 cryptocurrencies launched during that bull run have since bitten the dust, representing a staggering 53.6% of all dead coins on CoinGecko.

This trend isn’t new. The 2017-2018 bull run saw a similar collapse, with roughly 70% of the over 3,000 cryptocurrencies launched during that period ultimately failing.

The ease of launching new tokens, particularly memecoins, is partly to blame for the high number of dead coins. Many memecoin projects lack a clear purpose or underlying technology, leading to quick hype followed by swift abandonment. This trend was particularly prevalent during the 2020-2021 bull run, with a significant number of projects launched in 2021 now considered failures (over 70%).

Reports indicates that year 2023 shows a significant decrease in project failures. With a failure rate of less than 10%, it suggests a possible shift towards a more sustainable crypto ecosystem focused on building projects with real-world applications.

How CoinGecko Measured Dead Coins?

1. Lack of Trading Activity:

If a cryptocurrency hasn’t seen any trading activity in the past 30 days, it raises red flags. This inactivity suggests the coin might be defunct or have minimal interest from traders.

2. Exposed Scams:

CoinGecko stays vigilant for scams and “rug pulls” (sudden developer abandonment) within the crypto space. News reports or verified user reports can trigger investigations and potential delisting of these fraudulent projects.

3. Project Shutdown or Rebranding:

Sometimes, projects themselves decide to shut down or undergo a complete rebranding. If a team disbands or the project ceases to exist, CoinGecko may delist the associated cryptocurrency, especially if old tokens become unusable.

4. Major Token Overhauls:

In some cases, projects might undergo significant token changes. If these changes render old tokens unusable or highly illiquid according to CoinGecko’s standards, the original tokens might be classified as “dead.”

By considering these factors, CoinGecko provided a clearer picture of the cryptocurrency market, highlighting both active projects and those that have fallen by the wayside

How to Identify Dead Crypto Coins?

Red Flags of a Dead Coin:

- No Official Website or Inactive Website: A dead coin often lacks an active and accessible official website. Check for a functioning website with recent updates and clear information about the project.

- Abandoned Development: If the developers have abandoned the project or delisted it from major exchanges, it’s a strong sign the coin is no longer supported or progressing. Look for news or announcements from the development team.

- Negligible Trading Volume: Dead coins typically experience very low trading volume, often due to limited listings on reputable exchanges. Check the coin’s trading activity on reliable platforms like CoinMarketCap or CoinGecko.

- Zero or Little Social Media Presence: A healthy project fosters a community. Look for active social media channels (Twitter, Telegram, Discord) with ongoing discussions and a passionate community around the coin. Dead coins often have deserted social media pages.

Additional Tips:

- Research the Team: Look for a team with experience and a solid track record in the blockchain space. A team that’s anonymous or lacks credibility raises red flags.

- Read the Whitepaper: A well-written whitepaper outlines the project’s goals, technology, and roadmap. A poorly written or outdated whitepaper suggests a lack of seriousness.

- Consider the Coin’s Utility: Does the coin have a real-world use case and a strong value proposition? Coins with limited or unclear utility might not survive long term.

- Market Sentiment: Be cautious of coins with excessive hype or unrealistic promises. Look for projects with a solid foundation and a focus on long-term development.

Remember: Investing in cryptocurrency carries inherent risks. Always do your own research before investing in any coin, even those that don’t seem dead on arrival.

Conclusion:

This data is a wake-up call for aspiring crypto investors. The market is brimming with risky ventures. Understanding the high failure rate and the factors behind it can equip you to navigate this complex market and make informed investment decisions. Remember, in the crypto world, not all that glitters is gold!